Contractor tax calculator

Gorilla Accounting will accept no liability for. As an independent contractor youll have to pay 2 or 3 taxes depending on where you live.

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Protect your contract income if you cant work pay via your company.

.jpg)

. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Calculate your payroll tax quickly and easily using this payroll tax calculator from Ayers Group. Contractor Calculator the UKs authority on contracting serves a readership of over 200000 visitors per month see latest traffic report.

You will have to pay national insurance contribution and personal tax on your dividends as well. Use our self-employed tax calculator to see how much youll owe on taxes when you file your 1099 and how much you should be setting aside year-round. Effective payroll management solutions start with Ayers.

The information presented by the contractor tax calculator is for illustrative purposes only and merely produces a generic guide to your expected take home pay based on the information provided. This Tax and NI Calculator will provide you with a forecast of your salary as well as your National Insurance Contributions for the tax year of 202223. Our contractor calculator section provides you with a detailed illustration of what you could earn as a contractor.

Contractor Calculator the UKs authority on contracting serves a readership of over 200000 visitors per month see latest traffic report made up of contractors from IT telecoms engineering oil gas energy and other sectorsOnline since 1999 we publish thousands of articles guides analysis and expert commentary together with our financial tools and tax. Mortgage Tax Benefits Calculator. Federal income tax self-employment tax and potentially state income tax.

To keep the calculations simple you cant account for extra sources of income eg. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. In our opinion this is the least desired option as it will cost you more.

This calculator estimates your tax savings after a house purchase. Contractor Tax Tax News Contractor Tax Guides Contractor Tax Data Contractor Tax Dates Contractor Tax Expert. Use our Salary Tax Calculator to get a full breakdown of your federal and state tax burden given your annual income and location FREE 2022 Salary Tax Calculator.

One of the advantages of real estate investment is that some homeowners may qualify to deduct mortgage interest payments from their income when filing their taxes. They will also assist you with various tax loans and mortgage calculations. Insure yourself for 1000000 all paid for tax free by your limited company.

This salary calculator has the capability to display your pay details as they would have been back as far as 1999. Protection for Limited Company Directors. Youll get a rough estimate of how much youll get back or what youll owe.

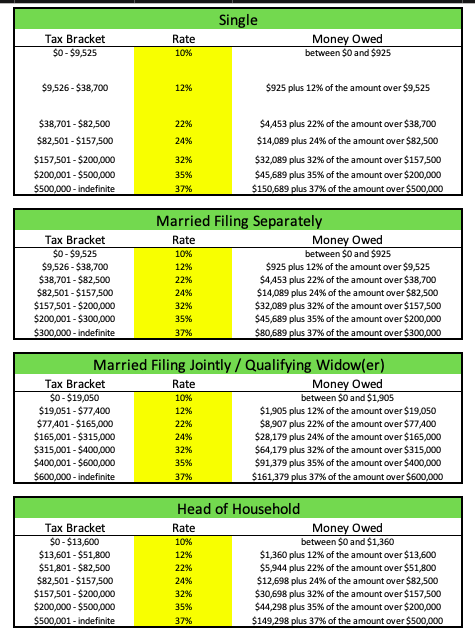

The new 2018 tax brackets are 10 12 22 24 32 35 and 37. Our free online tax calculator is all you need to compare your pay under a PAYE Umbrella Company Director Umbrella Company or Personal Limited Company. UK Employer National Insurance Calculator.

We can take control. Self Employed Tax. Work out how much Income Tax and Class 2 Class 4 National Insurance you will pay on your sole trader profits.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. But being a 1099 contractor isnt always straightforward. IT Contracting - Limited and Umbrella Contractor Guides.

Life insurance save up to 50 your ltd company pays the premiums. Presuming that you will get 85 net contractor income tax from an umbrella company and 75 from a limited company. For example if you have a business that earns 200 in revenue and has 75 in expenses then your taxable income is 125.

So are the number of people working as 1099 contractors. 2022 Tax Calculator Want an immediate sense of your earnings as Contractor. Whether its operating through your own limited company or via an umbrella company inside or outside IR35 these calculations will help you work out what you could take home.

For Companies For Self. If youre a sole proprietor or independent contractor. Select tax year.

Province Select Province Alberta British Columbia Manitoba New Brunswick Newfoundland and Labrador Northwest Territories Nova Scotia Nunavut Ontario Prince Edward. Remember that the tax year begins on April 6th of each year. It is especially confusing to file.

Is resourcing clients with professional contractor talent from Australia and overseas costing too much and overwhelming your admin team. If you are paid as a contractor you may receive compensation on a 1099-MISC. Our UK contractor calculators work out your tax liabilities working via a limited or umbrella company and inside and outside of IR35.

How Much Does A Small Business Pay In Taxes

The Independent Contractor Tax Rate Breaking It Down Benzinga

Self Employed Tax Calculator 2022 23 It Contracting

Self Employed Tax Calculator Business Tax Self Employment Self

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

The Independent Contractor S Guide To Taxes With Calculator Bench Accounting

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Income Tax Calculator Estimate Your Refund In Seconds For Free

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

2020 Tax Changes For 1099 Independent Contractors Updated For 2020

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

The Independent Contractor Tax Rate Breaking It Down Benzinga

Tax Rate Schedules And Important Rules For 1099 Contractors Taxhub

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

Federal Income Tax Fit Payroll Tax Calculation Youtube

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

How Much Should I Save For 1099 Taxes Free Self Employment Calculator