Furniture depreciation percentage

Percentage Declining Balance Depreciation Calculator. For a depreciation claim the effective life in years is converted to an annual percentage rate based on one of the two.

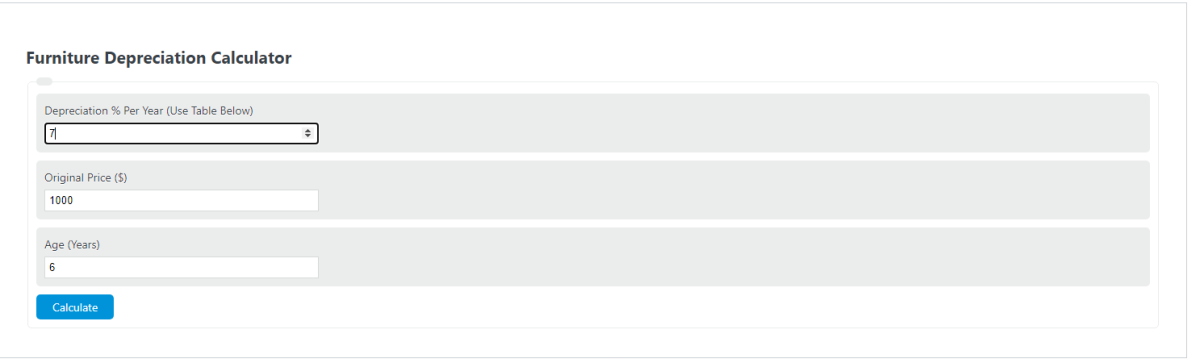

Furniture Depreciation Calculator Calculator Academy

Use our automated self-help publications ordering service at any time.

. You need to know the full title Guide to depreciating assets 2022 of the publication to use this service. The CE Shop pass rate - state portion. So if you paid 1000 for a couch five years ago it would now be worth only 400.

Depreciation allowance as percentage of actual cost a Plant and Machinery in generating stations including plant foundations i Hydro-electric34 ii Steam. 5 4 3 2 1 14. Transient Occupancy Tax 8.

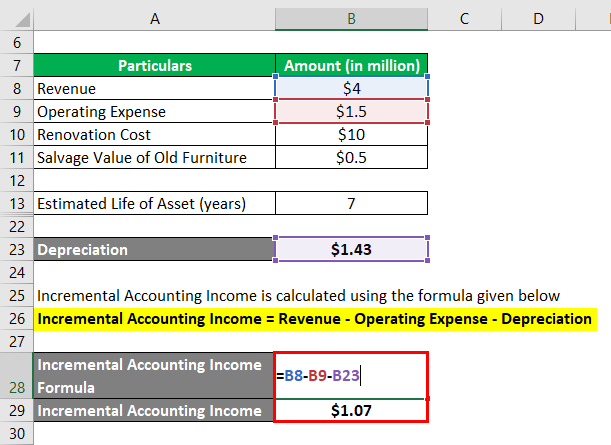

The furniture depreciation formula is the method of calculating income tax deduction for furniture used in businesses or other income-producing activities. The calculator should be used as a general guide only. State data provided by PSI.

Then plug this number. Age specific including cots changing tables floor sleeping mattresses high and low feeding chairs and stackable beds 5. 170 rows Class of assets.

Business tangible personal property taxes are billed semiannually and paid to the Loudoun County Treasurer by May 5 and October 5 of each year. On average furniture depreciates by about 20 per year. Daily Short Term Rental Tax.

By dividing the furnitures. For non-accountants calculating your office furniture depreciation can be confusing. And if you bought a dining room set.

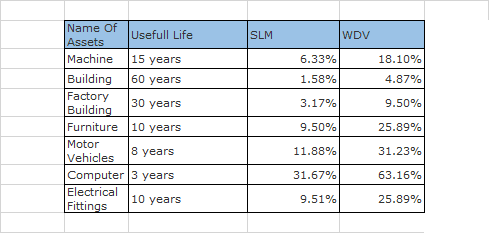

For 5 years this looks like this. State average - national portion. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Furniture Fixtures and Equipment. State average - state portion. How the depreciation deduction is calculated.

Most business tangible property except vehicles computer equipment and machinery tools will assess property starting at 80 of its original cost in the first year. 59 rows Furniture used by children freestanding. Additional information regarding Loudouns tax.

For example if you have an asset. To calculate depreciation using this method you start by adding the sum of all the years of useful life. So some businesses opt to do it the simplest way.

There are many variables which can affect an items life expectancy that should be taken into consideration. Computer Equipment in a Data Center.

Accounting Rate Of Return Formula Examples With Excel Template

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Of Furniture And Fixtures Download Scientific Diagram

![]()

Furniture Calculator Splitwise

Depreciation Formula Calculate Depreciation Expense

Depreciation Calculator For Companies Act 2013 Taxaj

Depreciation Rate Formula Examples How To Calculate

Depreciation Rate For Plant Furniture And Machinery

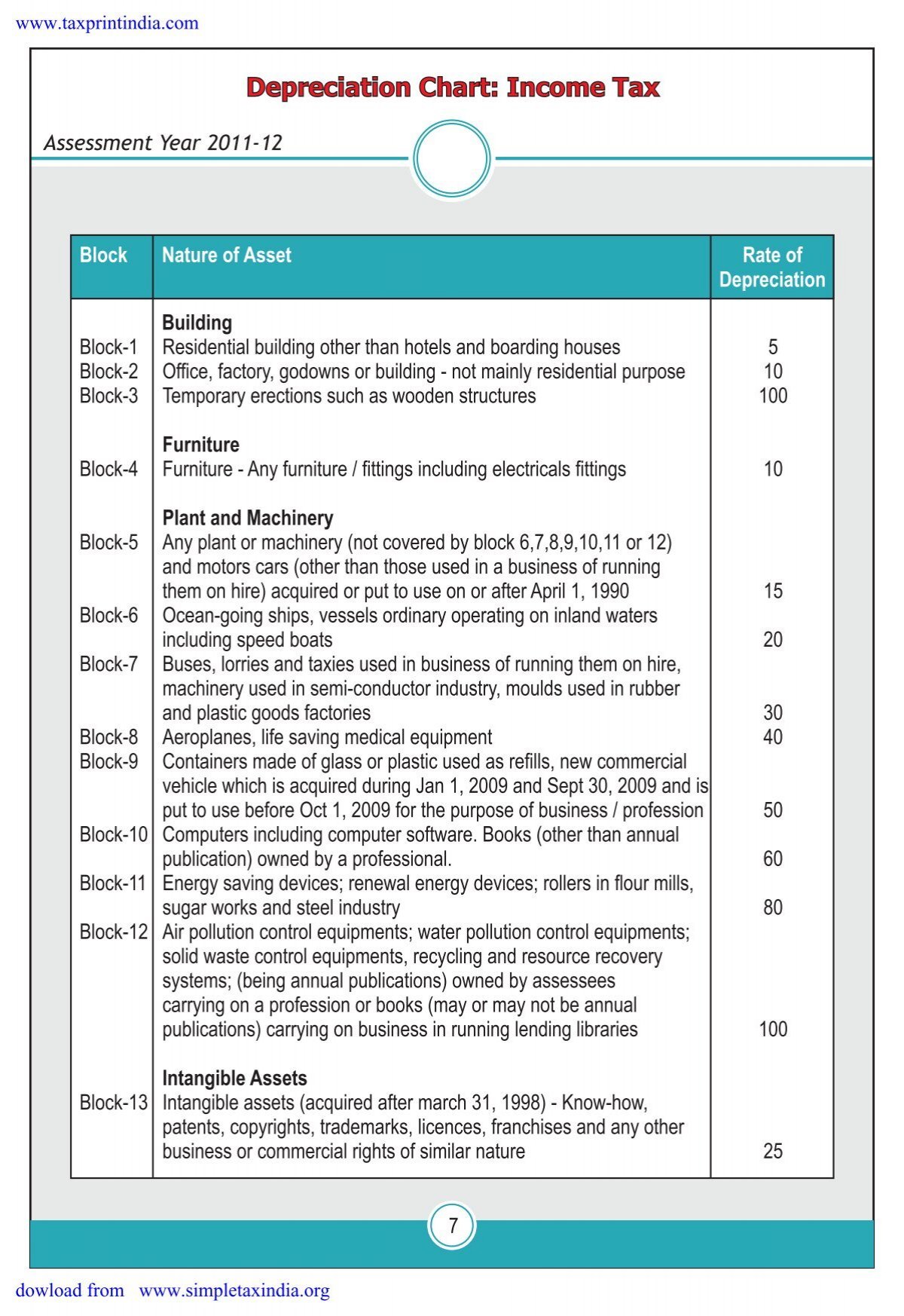

Depreciation Chart Income Tax

Furniture Depreciation Calculator Calculator Academy

How To Calculate Depreciation Expense For Business

The Book Value Of Furniture On 1st April 2018 Is Rs 60 000 Half Of This Furniture Is Sold For Youtube

Depreciation In Income Tax Accounting Taxation Income Tax Income Energy Saving Devices

Manufacturing Special Tools Depreciation Calculation Depreciation Guru

Depreciation Rate Formula Examples How To Calculate

Furniture Fixtures And Equipment Depreciation Calculation Depreciation Guru

Depreciation Formula Calculate Depreciation Expense